Empowering Communities

Together

Creating sustainable economic growth through accessible microfinance solutions and community partnerships

Our Vision and Mission

Our Vision

To be one of the leading and inclusive Microfinance in Ethiopia by 2030.

Our Mission

Committed to empower Women, Youth, Micro, Small and Medium Enterprises by providing sustainable, fast, most preferred and customer based Micro Financing Services through the expertise of qualified professionals and up-to-date technology.

Our Core Values

Commitment to growth

Accessibility

Service Excellence

Responsibility and Accountability

Transparency

Sustainability

Integrity

Yegna Microfinance Institution S.C. was established to support national economic growth by providing customized financial products. It primarily serves micro, small, and medium businesses, addressing financial gaps for low-income entrepreneurs while ensuring profitability and sustainability.

Licensed by the National Bank of Ethiopia, Yegna Microfinance started operations in 2022 with an initial capital of Birr 40 Million. The institution is backed by committed and experienced shareholders, working closely with governmental and financial organizations to expand financial inclusivity.

The logo represents sustainability, support, and financial inclusiveness:

- Green color symbolizes sustainable growth.

- Hand symbols represent financial support for low-income communities.

- Round shape signifies inclusivity in the financial system.

- 'Y' symbol reflects belonging and empowerment.

What We Do

Financial Empowernment

We provide innovative financial services and empower the community.

OUR NAME

Microfinance S.C

The Name Yegna Microfinance S.C symbolizes our commitment to financial empowerment, community growth, and sustainable development.

Our Impact

Our Evolution

Establishment & Vision

Yegna Microfinance Institution S.C was founded with the vision to drive Ethiopia’s economic development by offering tailored financial solutions to empower businesses and individuals.

Financial Inclusion

The institution focuses on bridging financial gaps by providing need-based services to micro, small, and medium enterprises (MSMEs), fostering economic growth and stability.

Industry Impact

With a dynamic team and strategic partnerships, Yegna Microfinance continues to expand, supporting economic inclusion and sustainable financial solutions.

Commitment to Growth

Yegna Microfinance Institution remains dedicated to financial empowerment, innovation, and sustainability, ensuring accessibility for all socioeconomic groups.

Board of Directors

Betelhem Tesfaye

Chairperson

Elias Amare

Member

Abiy Fiseha

Member

Ermias Mulugeta

Member

Executive Management Team

Tekalign Birhanu

CEO

Amanuel Mengesha

D/Chief Resource Mobilization & Partnership Officer

Natenael Tsegaye

D/Chief Credit Officer

Selam Dirshaye

A/Deputy Chief Finance and Facility Officer

Ebisa Derbie

D/Chief Human Capital Officer

Theodros Tesfaye

D/Chief Strategy and Innovation Officer

Kassa Melese

D/Chief IFMB Officer

Ezra Tilahun

Executive Assistant to the CEO

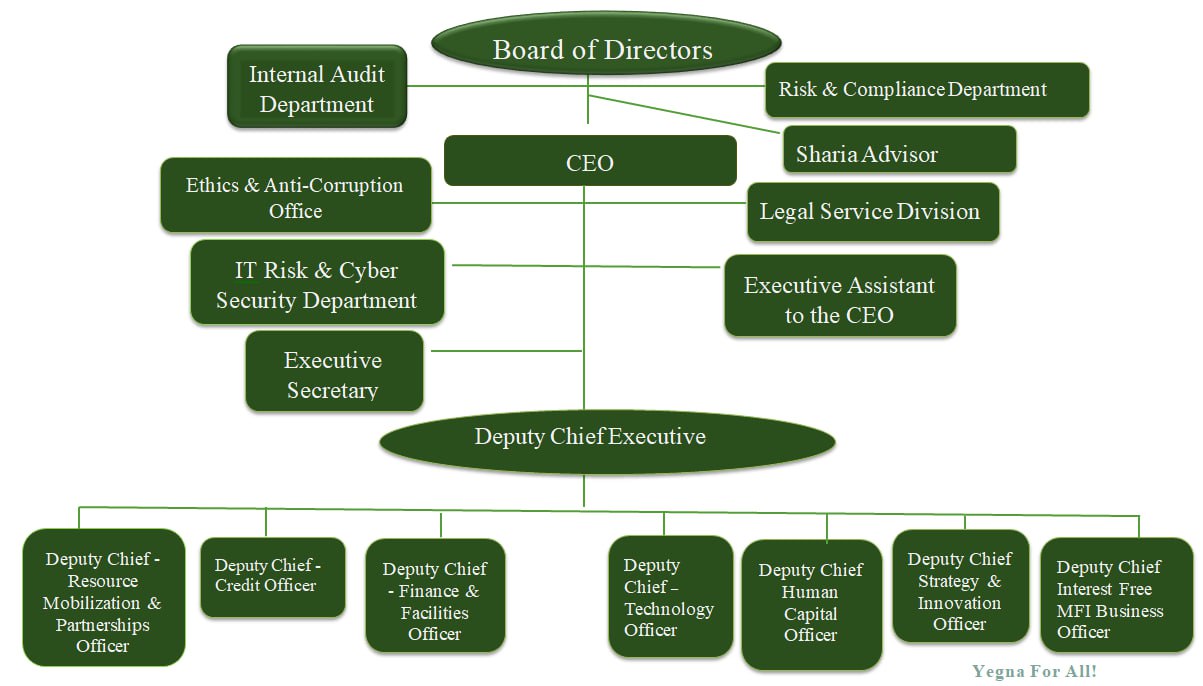

Organizational Structure

Need Help Finding Us?

Our customer service team is ready to assist you with directions or any inquiries.