Saving Products

Individual Voluntary Saving Account

Account opened for eligible individual customer to save in Yegna MFI to get higher interest rate.This Saving account bears minimum interest rate of 8.5% per annum.

Child Trust Saving Account (Minor)

Account opened for children and youth below age of 18 years.Opened and operated by parents or guardian,This Saving account bears minimum interest rate of 9% per annum.

Box Saving Account

Account dedicated to encourage small savers in both urban and rural areas who do not have easy access to saving facilities.Box is distributed to savers to save at their home/ business areas,It bears 8.5% interest rate per annum.

Women Saving Account

Account dedicated to women eligible customers to empower women with attractive value prepositions.The minimum interest rate is 9%,The account holder women have a privilege to get Etege loan facility from Yegna Microfinance S.C.

Organizational/ Institutional Saving Accounts

Account opened for formal organizations, institutions, clubs, associations, union, etc with very attractive interest rate.It bears minimum interest rate of 9.25% per annum.

Ikub Saving Account

Account dedicated as an adaptation of the traditional money saving experience (Ikub) in to modern microfinancing system to enable easy collection of funds with attractive value prepositions to members and leaders.The account has three types: Large, Medium and Small,It bears very attractive interest rate ranging from 11% to 12% per annum,Member and leader get credit faciltity from Yegna MFI at very minimal loan interest rate,Other value prepositions/ benefit attached to the account.

Idir Saving Account

Account dedicated for Idir associations to assist them with attractive interest rate and other value prepositions.It bears annual interest rate of 10.5% per annum,Overdraft loan facility attached to the account,Member and leader get affordable credit facility with very minimal loan interest rate,Other attractive value prepositions attached to the account.

Commitment Saving Account

Account opened to eligible customer in order to get credit facility on save and borrow principles.Loan attached to the account for purchase of Vehicles, house, household appliances, Consumer goods, school/college fees, for business start-ups, working capital, personal consumptions, purchase of other fixed asset, etc.Saving Modality: 20/80, 30/70, 40/60 and 50/50 for the minimum of 5 months with different saving options: in advance, equal monthly and other options.The account bears attractive interest rate of 9.25% per annum.

Time Deposit

Account opened for natural and legal persons with formal contractual agreement to deposit money for specified period with attractive negotiable interest rate.The minimum interest rate is 16.5% per annum and increase with the amount of deposit and duration of period (lock-in period).There are options on saving model with flexible saving option to increase principal at regular or irregular interval of periods.

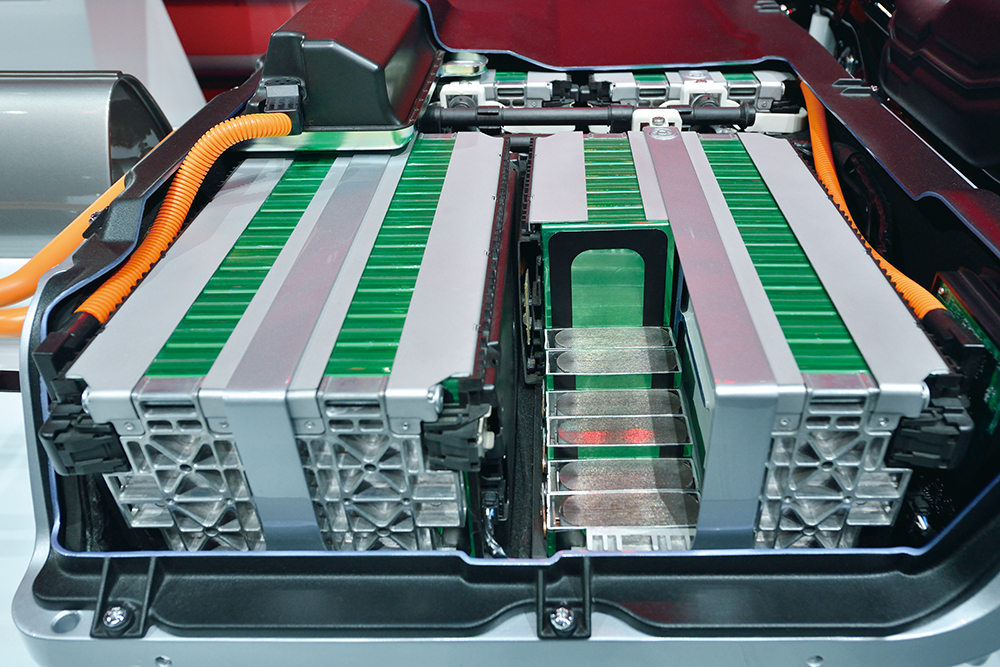

EV Battery Replacement Saving

Account opened to any eligible customer who want to save for the sake of replacement of EV-Battery and get loan attached to the account for EV-Battery replacement. 200% loan in excess of saving will be provided for clients for replacement of EV-Battery. The account gets annual interest rate of 10.5%.

Normal Compulsory Saving

Account opened for loan clients for saving upfront and ongoing compulsory saving as a pre-requirement to get loan facility from Yegna MFI.The account gets annual interest rate of 7%.